Vermilion Advantage is surveying its members on whether there should be a 1-percent increase in sales taxes to support county schools. Vicki Haugen, President of Vermilion Advantage, says the 1-percent County Schools Facilities Sales Tax is only being explored for possible placement on the spring ballot.

‘’Quality education (which includes facilities, curriculum, technology and faculty) is a critical component of successful economic development,’’ said Haugen in a letter sent to Vermilion Advantage members. ‘’However, so is an area’s overall cost-of-living,’’ added Haugen.

If voters approve the sales tax increase everything in the municipal and county sales tax base would be included except:

- Licensed and titled vehicles

- Boats and RVs

- Mobile homes

- Unprepared food

- Drugs (including vitamins and over-the-counter)

- Farm equipment and parts

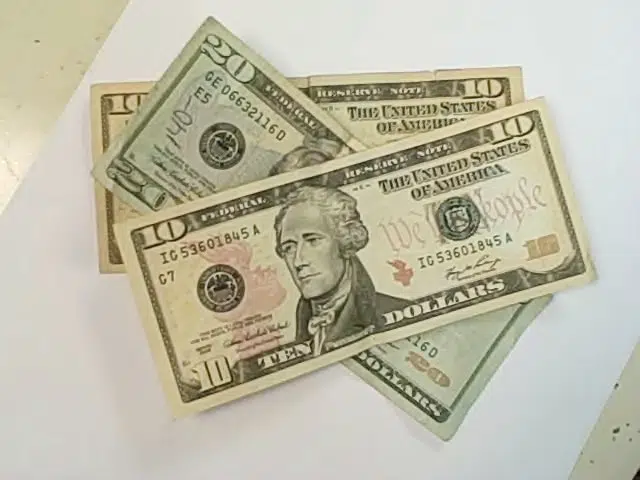

On items where the new tax would be paid it would mean paying $1-dollar in additional sales tax on a $100 item. A $500 item would have an additional $5 tax. And an item costing $1,000 would have an additional $10 in sales taxes on it.

Funds raised from the tax hike could be used by school districts for new facilities, additions and renovations, technology infrastructure, safety and security improvements, or energy efficiency improvements.

If the sales tax hike is approved, the sales tax rate in Danville would rise to 10.25%. Only three other cities in Illinois have a higher sales tax….River Grove, Cicero and Bellwood. Danville’s new sales tax rate would be the same as Chicago, Niles and Rosemont.